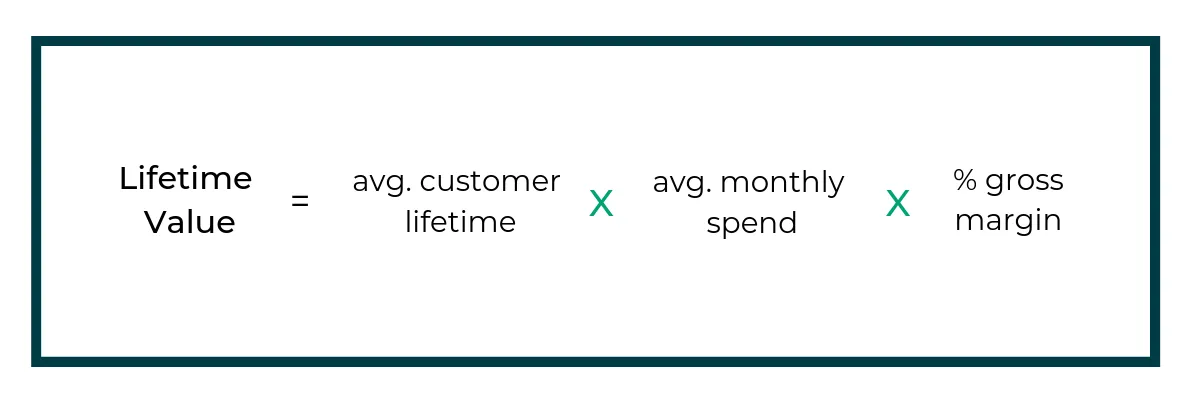

Here is the formula. When margins and retention rates are constant the following formula can be used to calculate the lifetime value of a customer relationship.

Loyalty Programs To Maximize Customer Lifetime Value Saasquatch

Loyalty Programs To Maximize Customer Lifetime Value Saasquatch

Lets say a customer visits your website 10 times and spends 10 each time.

Customer lifetime value formula. So this is a way to kind of look through the formula you know see what happens to the formula if you adjust some of these variables. Rs 1000 per month x 12 months x 3 years Rs 36000. Lets say a SaaS company generates 3000 each year per customer with an average customer lifetime of 10 years and a CAC of 5000 for each customer.

While most of the internet marketers are focusing on getting traffic conversion it is very rare they speak about customer lifetime value. By multiplying the value of a customer over a year average cart x number of purchases by the average lifetime of your customers 1-3 years you obtain the turnover that a customer brings in during his or her period of activity 1-3 years on your e-commerce site. The customer lifetime value of this customer would be.

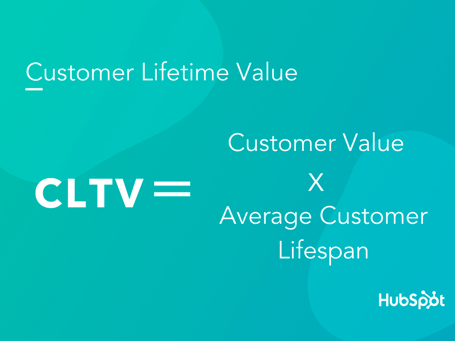

Customer Lifetime Value Average Value of Sale Number of Transactions Retention Time Period Profit Margin. In this article Im going to move straight into the importance of Customer Lifetime Value and the actionable ways you can use it to improve your. Customer Lifetime Value Client Value X Average Lifetime.

Predictive customer lifetime value formula. In practice determining the exact predictive CLV can be difficult when considering fluctuations in price discounts etc. CLTV demonstrates the implications of acquiring long-term customers compare to short-term customers.

If their expected lifetime goes up should their customer lifetime value go up too. After that multiply this number by the customer lifespan value 20 to get CLTV. Customer Lifetime Value Margin Retention Rate 1 Discount Rate Retention Rate displaystyle textCustomer Lifetime ValuetextMargincdot frac textRetention Rate1textDiscount Rate-textRetention Rate 1.

You can calculate a simple Customer Lifetime Value model for your company with this formula. The predictive CLV is a great indicator of the total value a customer will eventually give a business over their whole lifetime as it uses more collected data. For Starbucks customers that value turns out to be 25272 52 x 2430 x 20 25272.

So the Customer Lifetime Value of Starbucks turns out to be. The formula says it goes up and it makes intuitive sense. There are other methods of calculating CLV that get much deeper and can focus on the individual customer.

If youre looking for a simple way to calculate CLTV for yourself try our Customer Lifetime Value Calculator. The company could calculate CLV like this. CLV tells you how much profit your company can expect from a.

Customer Lifetime Value Lifetime Value Profit Margin. Customer lifetime value formula LTV ARPU average monthly recurring revenue per user Customer Lifetime You can also calculate lifetime value using churn which is a number you likely have more readily available. It helps a company identify how much revenue they can expect to earn from a customer over the life of their relationship with the company.

The CLV is equal to the total value of each transaction multiplied by your average gross margin. LTV ARPU User Churn. The simplest customer lifetime value formula is the historic model.

This means each customer is worth a lifetime value of Rs 36000. Lifetime value calculation The LTV is calculated by multiplying the value of the customer to the business by their average lifespan. Calculate Customer Lifetime Value CLV Finally you need to multiply the average customer value by 52.

Improving Customer Lifetime Value. Customer Lifetime Value 6 Step Formula to Maximize Customer Lifetime Value. 1000 annual profit from the customer X 5 number of years that they are a customer less 2000 acquisition cost 3000 CLV.

52 x 2430 x 20 25272. Customer lifetime value CLV or LTV for lifetime value helps you predict future revenue and measure long-term business success. What happens if retention increases.

Then the lifetime value of each customer is according to the formula above. Customer Lifetime Value is a monetary value that represents the amount of revenue or profit a customer will give the company over the period of the relationship. All it takes is to use historical data to predict future data and follow this simple customer lifetime value formula CLV Average Purchase Value x Average Purchase Frequency Rate x Average Customer Lifespan Suppose you own a shoe business serving two different customer segments office employees and athletes.

Since we were measuring customers on their weekly habits we need to multiply their customer value by 52 to reflect an annual average. Because you were measuring customers on a weekly basis you need to multiply their customer value by 52 weeks to reflect an annual average. 3000 10 - 5000 25000.

If you are not focusing on the customer lifetime value your business would not go anywhere.